This entire series was created to help YOU understand Arizona injury law a little better. We go over a LOT of the most common injury cases, as well as share some quirky things you may have never heard of before. Definitely check us out!

In The

Community

When you get into an accident, you need professionals you trust to see you through to the other side. Insurance companies, claims adjusters, and bill collectors may bombard you with phone calls in the aftermath of an accident – all while you are trying to deal with personal injuries and emotional distress. Hiring a Phoenix, Arizona trial lawyer can help you successfully resolve your case and obtain the compensation you need to move forward.

At Gerber Injury Law, we have helped clients achieve justice and fair recoveries for their injuries for nearly 30 years. Clients throughout Arizona trust us with their most complex cases.

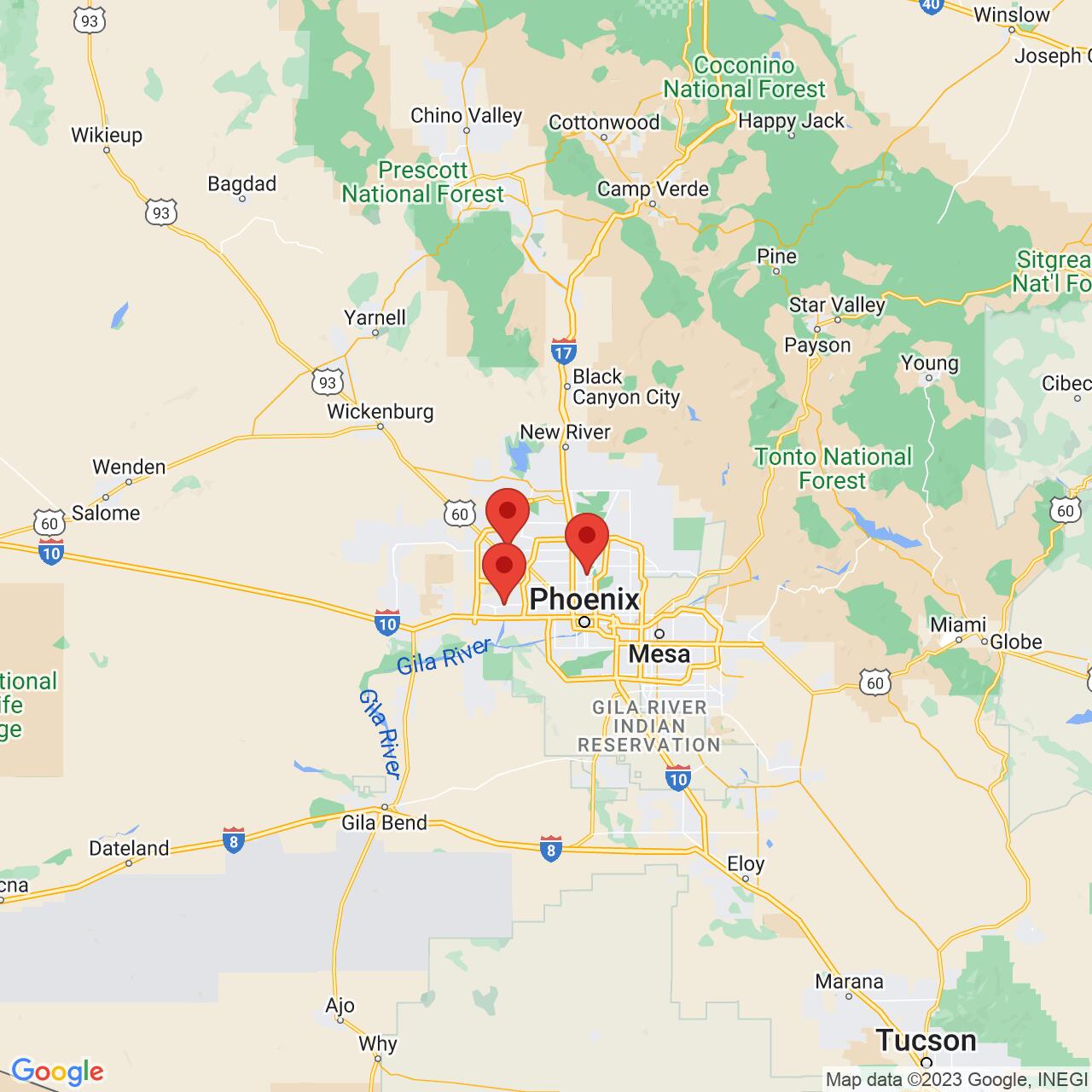

Our service areas include but are not limited to:

Surprise, El Mirage, Glenville, Litchfield Park, Avondale, Goodyear, Glendale, Maryvale, Peoria, Sun City, and Buckeye.

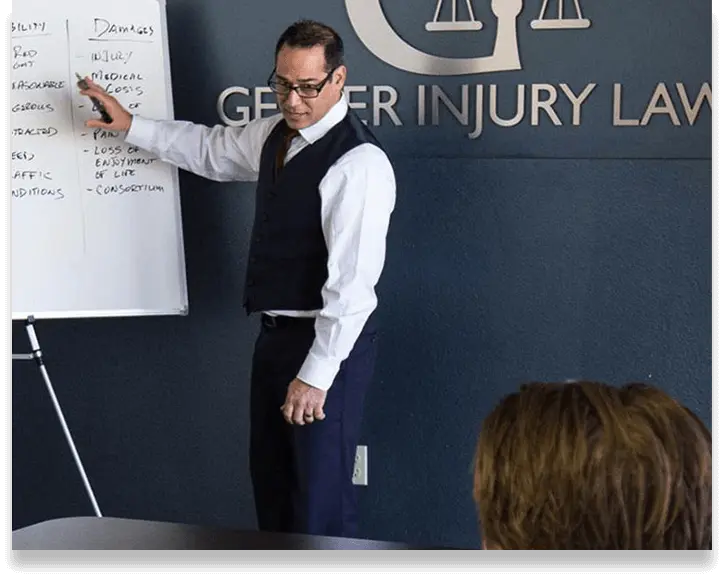

We can meet with you one-on-one to discuss how we will use our tailored legal strategies to help you achieve your goals. We will guide you through the claims process to make it as stress-free as possible. So if you’ve been in an accident, contact us today to meet with Attorney Ken Gerber during a free consultation.”

We can meet with you one-on-one to discuss how we will use our tailored legal strategies to help you achieve your goals. We will guide you through the claims process to make it as stress-free as possible. Contact us today to meet with Attorney Ken Gerber during a free consultation.

Hiring a Phoenix personal injury lawyer to oversee your case can be the best decision you make after an accident. You cannot trust an insurance company to handle your claim fairly unless you have a lawyer protecting your best interests. Insurance companies are more interested in their bottom line than your recovery. Hiring an attorney gives you important resources and capabilities, such as negotiating a higher settlement with an insurer. You can have peace of mind while an attorney takes over your claim.

As someone seriously injured in an accident, you have legal rights. The civil justice system in Arizona allows you to seek financial compensation to make you whole again. You may bring a claim against one or more parties who were responsible for your accident in pursuit of money damages. A positive settlement or jury verdict could result in payments for many of your accident-related losses.

The compensation you obtain for your personal injury accident could help you and your family pay for related expenses and move forward. The value of your award will depend on many factors, including your specific injuries and how much they impacted you. Hiring a trial lawyer from Gerber Injury Law can improve your chances of securing the maximum amount for your injuries and damages

Attorney Ken Gerber graduated cum laude from Stetson College in St. Petersburg, Florida. He went on to work as a prosecuting attorney, handling more jury trials than any of his peers in the same . His background in jury trials led Ken to work for a plaintiff’s personal injury law firm until 2001, when he founded Gerber Injury Law. He moved his practice to Arizona in 2009, where he remains committed to the very best in client service as a top trial lawyer in Phoenix and the surrounding areas.

Gerber Injury Law is a highly qualified law firm that has been helping clients obtain the personal injury claim payouts they deserve for more than two decades.

At Gerber Injury Law, we are friends first, lawyers second. Our clients become like family. Ken and his team will treat you with respect, kindness, and compassion every step of the way. If you have an injury from any type of accident in Phoenix, Avondale, Scottsdale, Mesa, or Surprise, Arizona, do not hesitate to contact us for a free consultation. Request yours 24/7 at (623) 486-8300.

If you or a loved one has been injured, don’t hesitate – contact our attorneys today!

Phoenix