A car accident in Arizona can force you to deal with many challenges, such as undergoing treatments for your injuries and taking time off of work. One of the common issues drivers face is needing to rent a car to carry out day-to-day tasks. If you did not cause your car accident in Arizona, you should not have to pay for the costs of a rental. Learn how to navigate the insurance process for optimal coverage.

File a First-Party Insurance Claim

Arizona is a fault-based insurance state. After a vehicle collision, you should not have to pay for your damages or losses out of pocket if the other driver was negligent or reckless in causing the wreck. In Arizona, the at-fault driver will be responsible for all crash-related damages. These include the cost of renting a car if the crash put yours in the shop. Typically, you will file an insurance claim demanding benefits from the at-fault driver’s insurance company in Arizona. It could be faster, however, to file a claim for rental car costs with your own insurance provider.

Another driver’s insurance company may intentionally delay the claims process to avoid paying you for as long as possible. It may ask you for an excessive amount of proof of damages, for example, or schedule an in-person visit to see your damaged vehicle weeks after the car accident. In the meantime, you may not want to – or financially be able to – pay your rental car costs out of pocket. Rather than waiting for a third-party insurance company to accept your claim and issue a check, you can use a system called insurance subrogation to obtain benefits from your own auto insurance policy.

Insurance subrogation describes an insurance provider pursuing damages from another provider on behalf of an injured victim. Rather than you seeking benefits directly from the other driver’s insurer yourself, you could file a first-party claim with your insurance company. Your insurer will provide benefits up to your policy’s maximum. This will include rental car coverage if you have this optional type of insurance. Then, your insurance company will request reimbursement from the other driver’s carrier.

Hold the Other Driver Liable

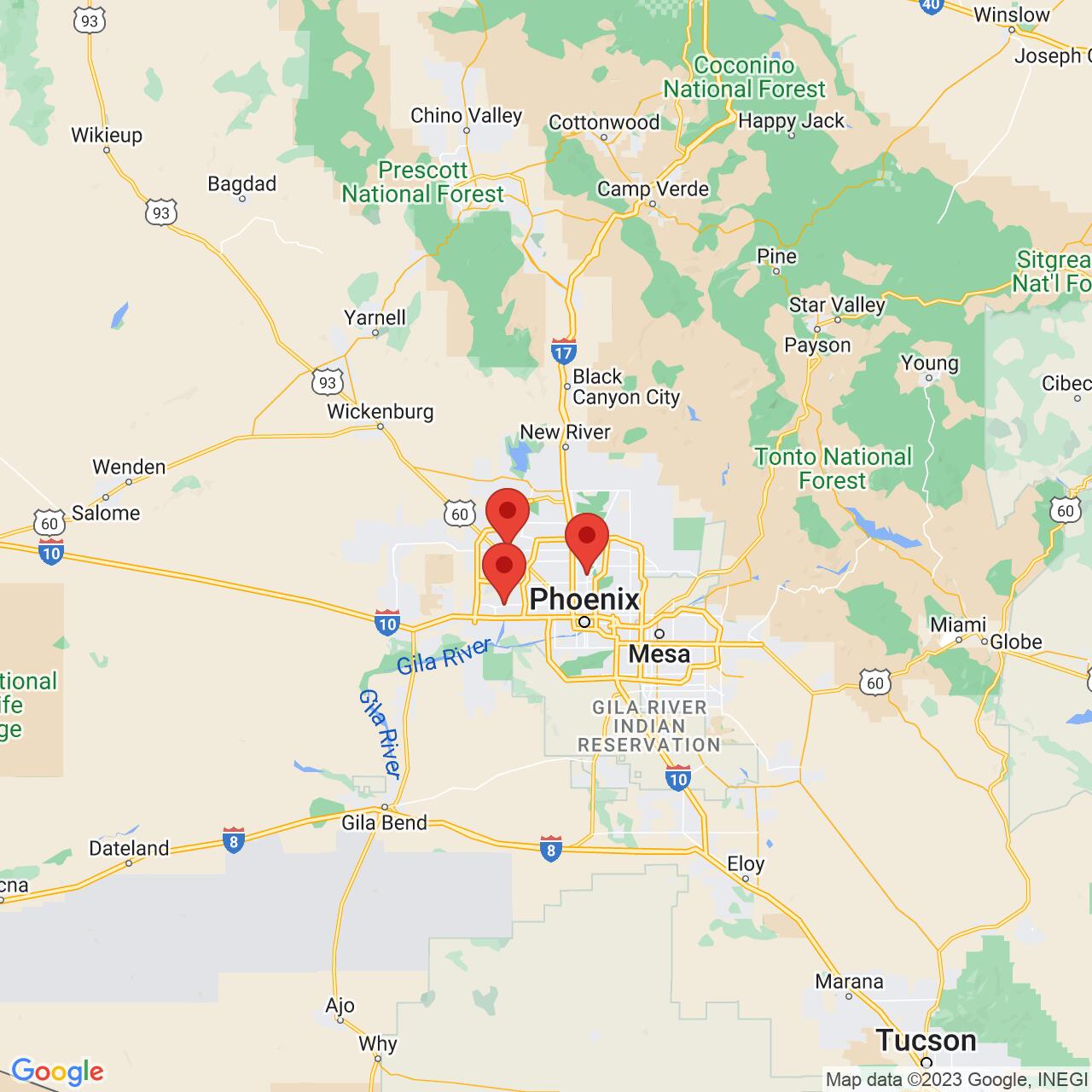

A first-party insurance claim is often the best choice for obtaining compensation to cover a rental car after an accident in Arizona. Rental car insurance should cover 100% of the cost of renting a car that is comparable to yours while your vehicle is in the shop. Your insurance company may work directly with a rental car company in Phoenix, meaning you will not have to pay out of pocket for the rental. The rental company will bill your insurance carrier directly.

Sometimes, however, first-party insurance is not an option. You may not be eligible for benefits if you did not purchase the additional coverage necessary to cover a rental. This is not a mandatory type of auto insurance in Arizona. You may have to pay out of pocket to rent a car at first if you cannot wait for a settlement. Then, you or your Phoenix car accident attorney can list the costs of the rental as part of your third-party insurance claim. In this scenario, you will have to wait for the at-fault driver’s insurance company to accept your claim and write you a check to receive reimbursement for any out-of-pocket rental car costs.

Unfortunately, many insurance companies deny liability. The other driver’s insurance carrier may refute your claim or try to allege that you caused the accident. This can draw out the insurance process. It could be in your best interest to hire an attorney to help you prove liability. An attorney can go up against the other party’s insurance provider on your behalf, seeking fair and full coverage for your crash-related losses. Your lawyer can help you prove damages such as the costs of a rental car. A lawyer will make sure you do not end up paying for a rental if you did not cause the car accident.